Are you wondering why you are left with little or no money every month, then you are probably asking the question, “where is my money going?” Everything feels so expensive right now and inflation is hitting everyone as rising energy costs impact our daily lives. Families are being pushed to breaking point as they struggle to buy the basics and put food on the table for their children whilst others are lucky to be flying around the world in their private jets. No this does not seem fair but we don’t want to think about the unfairness in the world right now as we don’t want to waste our time and energy, instead we need to think about how to make things easier for ourselves and our families.

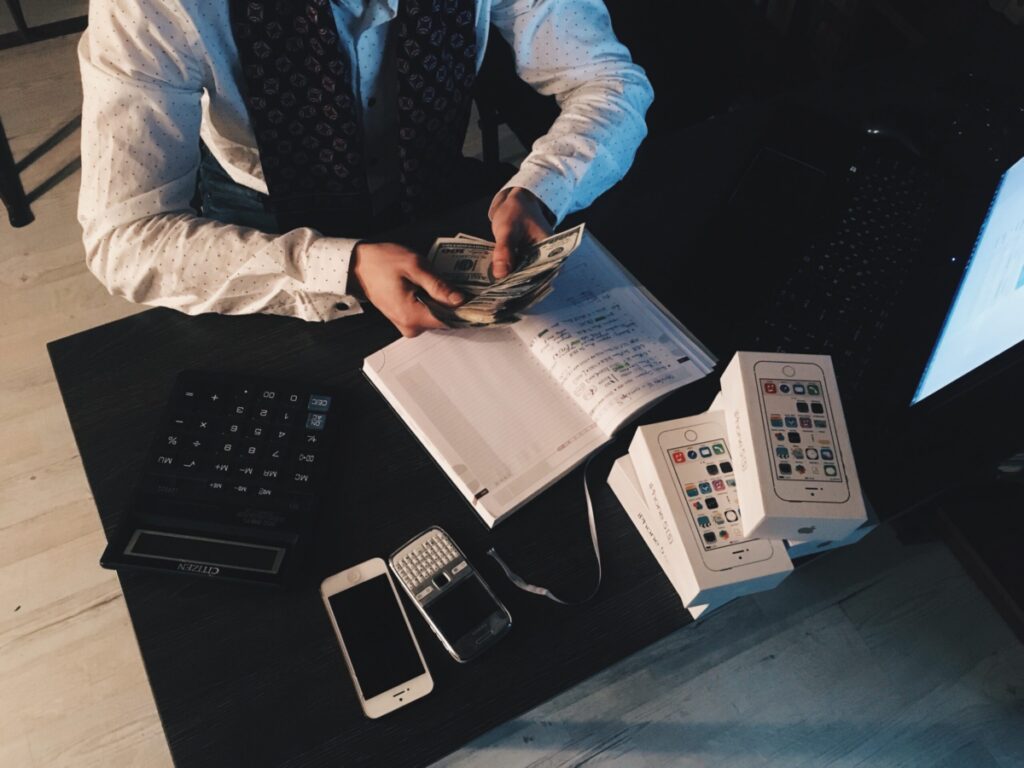

The first thing that you need to do is understand your income; how much are you earning from your day job, rental properties, side hustle or passive income sources. This will help you to work out how much you will be able to save and to think about the ways that you are spending your money.

The next step is to calculate all your expenses; this can include your mortgage, rent, utilities, property tax, car, credit cards, groceries and whatever else you spend your money on each month.

CREATE A BUDGET

Once you understand your income and you have an idea of your expenses, start a budget as this will help to create financial stability and you will be able to track where you are spending your money so that you don’t run out of money each month.

The most important reasons for creating a budget are:

- It can help you control your spending

- It can help you track your expenses

- It can help you make better financial decisions and save more money

I don’t believe in fixed rules for saving money as everyone has a different income, however, try to save at least 10% of your income and organise your budget according to 3 categories: needs, wants and saving goals.

Your needs are essential expenses that cannot easily be changed and you cannot live without so they need to be paid, for example:

Your needs might include:

- Your rent or mortgage

- Utilities

- Groceries essentials

- Transportation

- Credit card payments

Your wants are those additional luxuries that are something that you don’t really need such as a new pair of shoes or phone only because it’s popular and everyone else has it. If you want to save more money, you need to look at your wants and how you are spending money as this is the first place to make changes.

Your wants might include:

- Gym membership

- Holidays

- Clothes shopping

- Electronics

- Entertainment and subscriptions

Your savings can be money that you are saving for a rainy day or future expenses. If you consistently plan and put 10% of your money into savings then you can build an emergency fund for unemployment or unexpected life events.

Your saving goals might include:

- Building an emergency fund

- Savings for a deposit on property

If you have debts, aim to pay those off as soon as possible to allow you to save more money. If you are on a lower income and not able to save money, try to increase your earnings by working extra hours or use your skills to earn extra money with a side hustle.

This is only a guideline as you can always make changes as your income increases or circumstances change.

I have found the best way to start saving money is by living a minimalist lifestyle. Do you really need all those extra pairs of shoes that you will never wear or those extra dresses that are just hanging in the wardrobe waiting to be worn?

Learn to live with less clutter, start to simplify your life and this will train your mind to live with the essentials and you will realise that you don’t need much to be happy. Throw away old clothes, books and anything else that has been gathering dust and hasn’t been worn or used in over 6 months. Free your mind, create the space for new energy to start flowing for abundance.

WHAT ARE THE 10 WAYS TO SAVE MONEY

Here are 10 ideas on how to save money:

- Make a list when you go to the supermarket and only buy the essentials that you really need

- Stop paying for NETFLIX or any other subscriptions

- Bring your own lunch to work

- Look at ways you can reduce your energy bills, switch to cheaper companies

- Plan your meals for the week and avoid throwing away food

- Cut down on eating out at restaurants

- Stop smoking, it will also improve your health!

- Drive a more affordable car, save on car insurance and maintenance costs

- Look for competitive prices and switch to cheaper internet provider

- Look for competitive prices on mobile phones and switch to a new contract

THINK BEFORE YOU BUY

If you go shopping, you will always find something to buy. It is the power of temptation and your emotions will try and trick you into buying a new dress or another pair of shoes. If you see something in the store that you like, always think, “do I need it?” If you don’t need to buy it right away, then take the time to think about it. You can always return to the store the following day or order the item online. It is always best to think things through before you make an impulse buy. It is common to want to buy EVERYTHING YOU SEE in the store as EVERYTHING looks good. I used to buy a lot of clothes but I found that I didn’t need half of what I bought and it was a waste of time and money as most of the clothes were never worn and they just occupied my space in the cupboards! Now I only buy what I need and I don’t visit the shopping malls as much as I used to and I have taught myself to say no to things that I don’t need!

ACTION PLAN TO SAVE MONEY

Create an action plan to save money. Start slowly so you don’t feel overwhelmed with cutting out so many things from your life. If you feel that there is temptation to buy something when you are on social media then limit viewing social media to once a week. We live in a world where people like to share the new things they’ve bought on social media and it can seem hard to keep up with everyone. You don’t need to buy the latest phone or have a new house just because friends on social media are buying all these things.

THE FUTURE IS YOURS

You don’t need to keep up with what others are doing, stay focused on yourself and the things that add meaning to your life. Your friends might be showing off their cars and vacations but they will not share their financial struggles to afford these luxuries. On the other hand you have realised that you don’t need to keep up with others and you are learning that paying off debt and saving money will allow you to live a healthier lifestyle with financial freedom for your future.